Solve each equation. ln(2x+1)+ln(x−3)−2 ln x=0

Table of contents

- 0. Review of Algebra4h 18m

- 1. Equations & Inequalities3h 18m

- 2. Graphs of Equations1h 43m

- 3. Functions2h 17m

- 4. Polynomial Functions1h 44m

- 5. Rational Functions1h 23m

- 6. Exponential & Logarithmic Functions2h 28m

- 7. Systems of Equations & Matrices4h 5m

- 8. Conic Sections2h 23m

- 9. Sequences, Series, & Induction1h 22m

- 10. Combinatorics & Probability1h 45m

6. Exponential & Logarithmic Functions

Solving Exponential and Logarithmic Equations

Problem 102

Textbook Question

To solve each problem, refer to the formulas for compound interest. A = P (1 + r/n)tn and A = Pert Find t, to the nearest hundredth of a year, if \$1786 becomes \$2063 at 2.6%, with interest compounded monthly.

Verified step by step guidance

Verified step by step guidance1

Identify the given values: the principal amount \(P = 1786\), the amount after time \(A = 2063\), the annual interest rate \(r = 2.6\% = 0.026\), and the compounding frequency \(n = 12\) (monthly).

Write down the compound interest formula for interest compounded periodically: \(A = P \left(1 + \frac{r}{n}\right)^{nt}\).

Substitute the known values into the formula: \$2063 = 1786 \left(1 + \frac{0.026}{12}\right)^{12t}$.

Divide both sides by 1786 to isolate the exponential term: \(\frac{2063}{1786} = \left(1 + \frac{0.026}{12}\right)^{12t}\).

Take the natural logarithm of both sides to solve for \(t\): \(\ln\left(\frac{2063}{1786}\right) = 12t \cdot \ln\left(1 + \frac{0.026}{12}\right)\). Then, solve for \(t\) by dividing both sides by \$12 \cdot \ln\left(1 + \frac{0.026}{12}\right)$.

Verified video answer for a similar problem:

Verified video answer for a similar problem:This video solution was recommended by our tutors as helpful for the problem above

Video duration:

8mPlay a video:

Key Concepts

Here are the essential concepts you must grasp in order to answer the question correctly.

Compound Interest Formula

The compound interest formula calculates the amount A accumulated over time with principal P, interest rate r, number of compounding periods n per year, and time t in years. It is given by A = P(1 + r/n)^(nt), which accounts for interest being added periodically, causing exponential growth.

Recommended video:

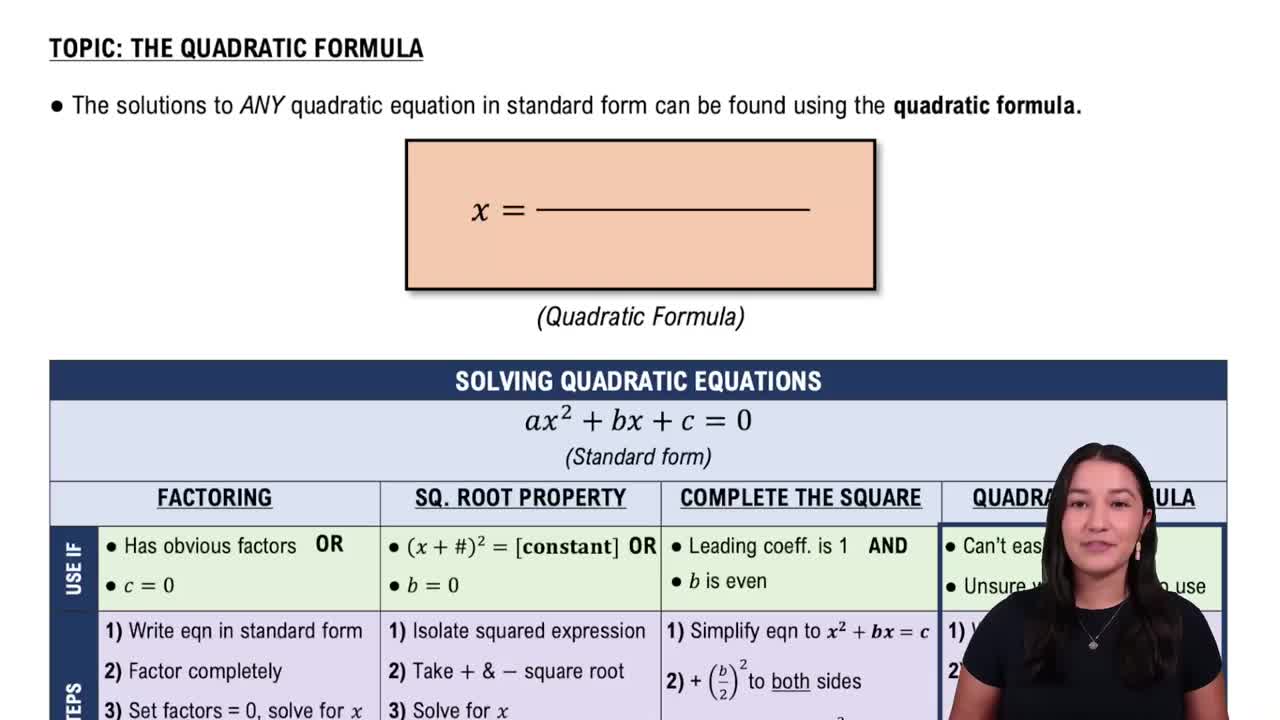

Solving Quadratic Equations Using The Quadratic Formula

Solving for Time in Exponential Equations

To find the time t in compound interest problems, you often need to solve an exponential equation. This involves isolating the exponential term and using logarithms to solve for t, since t appears as an exponent in the formula.

Recommended video:

Solving Exponential Equations Using Logs

Interest Rate and Compounding Frequency

The interest rate r must be expressed as a decimal, and the compounding frequency n affects how often interest is added. Monthly compounding means n = 12, which influences the growth rate and the calculation of time needed for an investment to reach a certain amount.

Recommended video:

The Number e

4:46m

4:46mWatch next

Master Solving Exponential Equations Using Like Bases with a bite sized video explanation from Patrick

Start learningRelated Videos

Related Practice

Textbook Question

732

views