The figure shows the graph of f(x) = ex. In Exercises 35-46, use transformations of this graph to graph each function. Be sure to give equations of the asymptotes. Use the graphs to determine graphs. each function's domain and range. If applicable, use a graphing utility to confirm your hand-drawn h(x) = e2x + 1

Table of contents

- 0. Review of Algebra4h 18m

- 1. Equations & Inequalities3h 18m

- 2. Graphs of Equations1h 43m

- 3. Functions2h 17m

- 4. Polynomial Functions1h 44m

- 5. Rational Functions1h 23m

- 6. Exponential & Logarithmic Functions2h 28m

- 7. Systems of Equations & Matrices4h 5m

- 8. Conic Sections2h 23m

- 9. Sequences, Series, & Induction1h 22m

- 10. Combinatorics & Probability1h 45m

6. Exponential & Logarithmic Functions

Introduction to Exponential Functions

Problem 53b

Textbook Question

Use the compound interest formulas A = P (1+ r/n)nt and A =Pert to solve exercises 53-56. Round answers to the nearest cent. Find the accumulated value of an investment of \$10,000 for 5 years at an interest rate of 1.32% if the money is b. compounded quarterly

Verified step by step guidance

Verified step by step guidance1

Identify the given values: principal P = 10,000, time t = 5 years, interest rate r = 1.32% (which is 0.0132 as a decimal).

For parts a, b, and c, use the compound interest formula , where n is the number of compounding periods per year.

Calculate the accumulated value for each compounding frequency: semiannually (n=2), quarterly (n=4), and monthly (n=12) by substituting the respective n values into the formula.

For part d, use the continuous compounding formula , substituting the values of P, r, and t.

After substituting the values into the formulas, compute the expressions and round the results to the nearest cent to find the accumulated values for each case.

Verified video answer for a similar problem:

Verified video answer for a similar problem:This video solution was recommended by our tutors as helpful for the problem above

Video duration:

4mPlay a video:

Key Concepts

Here are the essential concepts you must grasp in order to answer the question correctly.

Compound Interest Formula

The compound interest formula A = P(1 + r/n)^(nt) calculates the accumulated amount A after t years, where P is the principal, r is the annual interest rate, n is the number of compounding periods per year, and t is time in years. It accounts for interest earned on both the initial principal and the accumulated interest.

Recommended video:

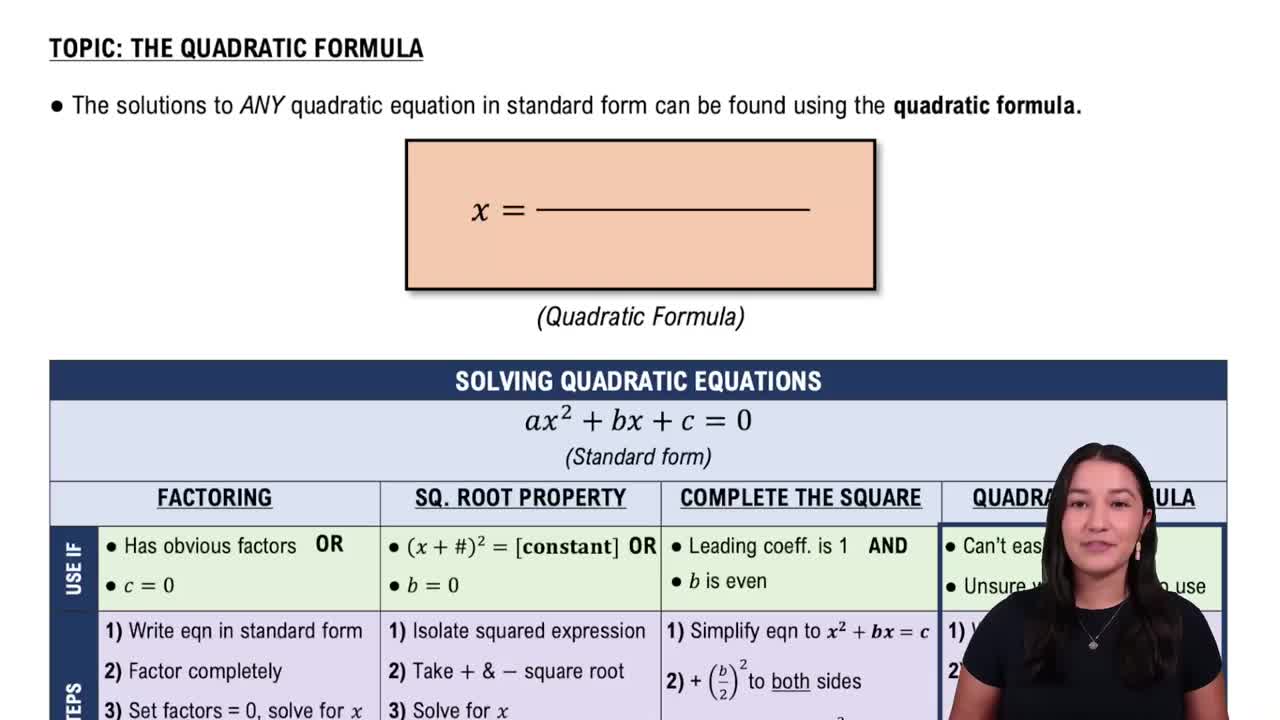

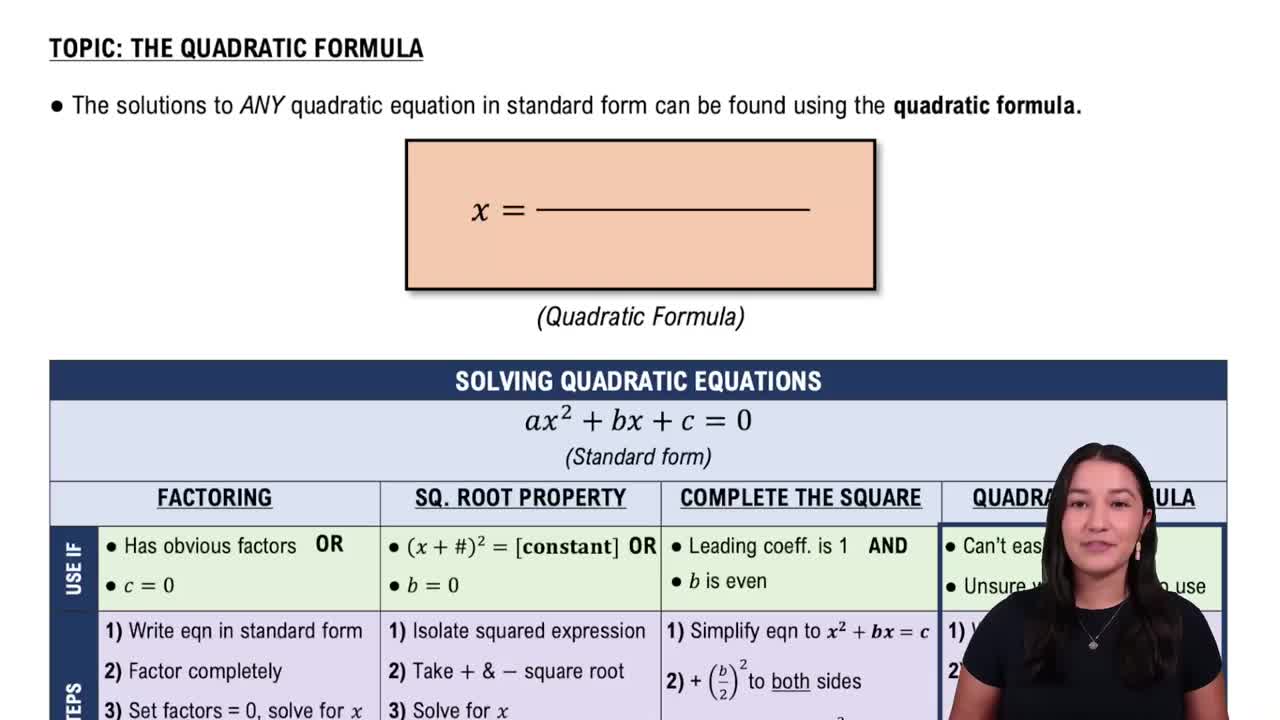

Solving Quadratic Equations Using The Quadratic Formula

Continuous Compounding Formula

Continuous compounding uses the formula A = Pe^(rt), where e is Euler's number (~2.718), to calculate the accumulated amount when interest is compounded an infinite number of times per year. This formula models the limit of compound interest as compounding frequency increases indefinitely.

Recommended video:

Solving Quadratic Equations Using The Quadratic Formula

Rounding and Financial Precision

Rounding to the nearest cent means expressing the final amount to two decimal places, reflecting standard currency format. This ensures practical and accurate financial reporting, especially important when dealing with money and interest calculations.

Recommended video:

The Number e

6:13m

6:13mWatch next

Master Exponential Functions with a bite sized video explanation from Patrick

Start learningRelated Videos

Related Practice

Textbook Question

647

views