Cost of Goods Sold - Perpetual Inventory vs. Periodic Inventory definitions Flashcards

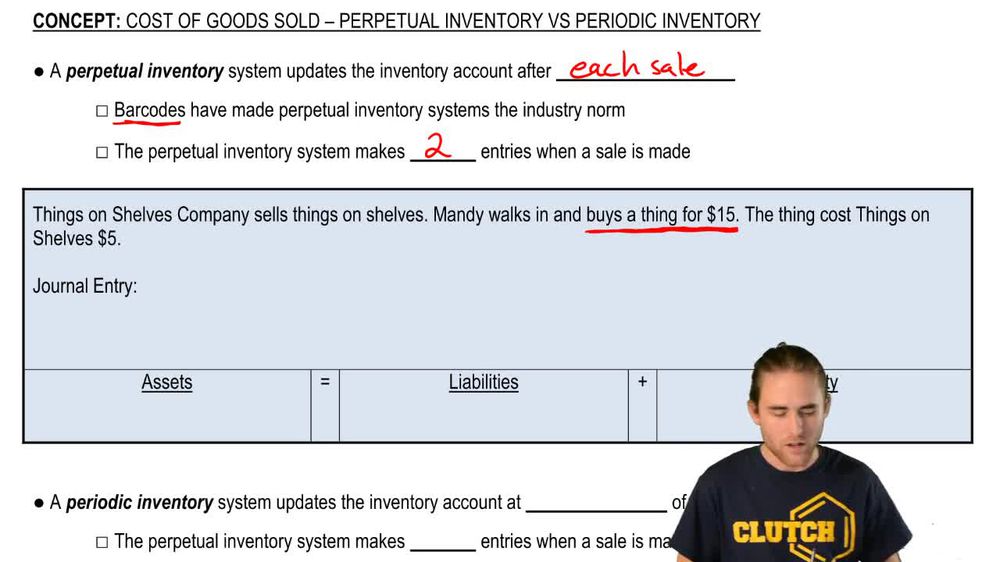

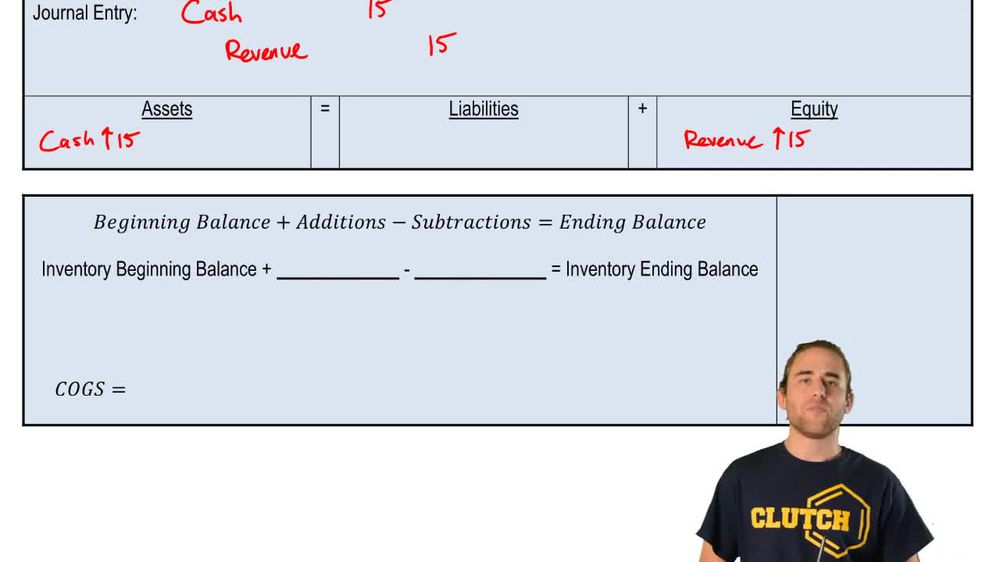

Cost of Goods Sold - Perpetual Inventory vs. Periodic Inventory definitions

You can tap to flip the card.

Control buttons has been changed to "navigation" mode.

1/15

Perpetual Inventory SystemAccounting method that updates inventory and cost of goods sold accounts immediately after each sale using real-time data.Periodic Inventory SystemInventory method that updates inventory and calculates cost of goods sold only at the end of the accounting period.Cost of Goods SoldExpense representing the direct cost to acquire or produce items sold during a specific period.Revenue EntryJournal entry recording the income received from sales, typically involving a debit to cash and a credit to revenue.Inventory AccountAsset account tracking the value of goods held for sale by a business at any given time.T AccountVisual tool used in accounting to represent debits and credits for a particular account, aiding in calculations.Beginning InventoryValue of inventory a company has on hand at the start of an accounting period.PurchasesAdditions to inventory during an accounting period, increasing the inventory account balance.Ending InventoryValue of inventory remaining unsold at the end of an accounting period, often determined by physical count.Expense AccountAccount type used to record costs incurred by a business, such as cost of goods sold, reducing equity.Accounting EquationFundamental relationship: Assets = Liabilities + Equity, maintained through all accounting entries.Physical CountProcess of manually counting inventory items to determine the actual quantity on hand at period end.DebitAccounting entry that increases asset or expense accounts and decreases liability, equity, or revenue accounts.CreditAccounting entry that increases liability, equity, or revenue accounts and decreases asset or expense accounts.AssetResource owned by a business, such as cash or inventory, expected to provide future economic benefit.