14. Financial Statement Analysis

Ratios: Book Value per Share of Common Stock

14. Financial Statement Analysis

Ratios: Book Value per Share of Common Stock

Practice this topic

- Multiple Choice

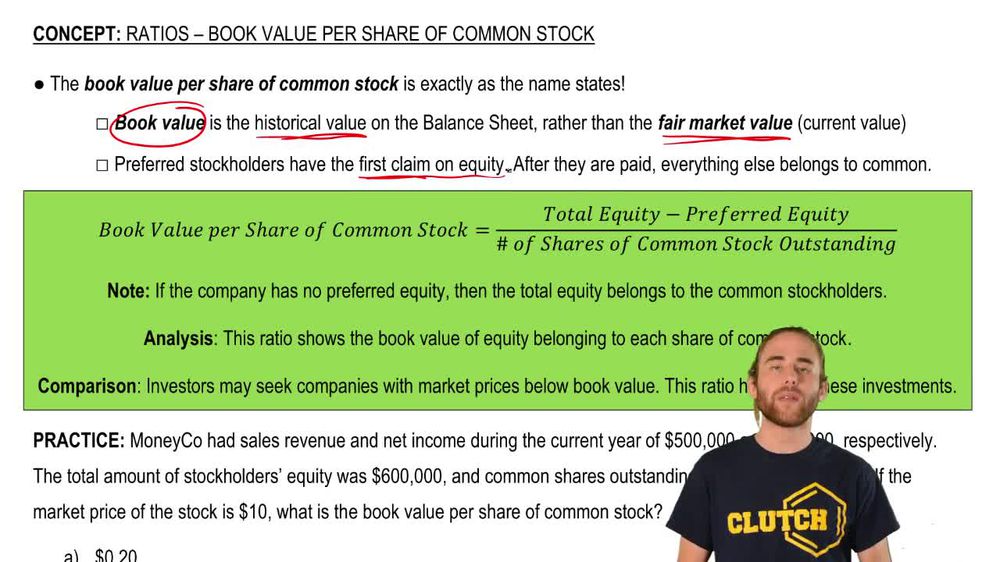

MoneyCo had sales revenue and net income during the current year of \$500,000 and \$60,000, respectively. The total amount of stockholders' equity was \$600,000, and common shares outstanding were 120,000 all year. If the market price of the stock is \$10, what is the book value per share of common stock?

160views - Multiple Choice

Tougher Company's current year income statement showed an EPS of \$1.25 per share. If total equity was \$600,000 (40,000 common shares, \$1 par), preferred dividends were \$10,000 (10,000 preferred shares with \$10 book value each), and the market price of common and preferred stock are \$25 and \$50, respectively, what is the book value per share of common stock?

165views1rank - Multiple ChoiceWhich of the following best describes the market value per share of common stock?99views