3. Accrual Accounting Concepts

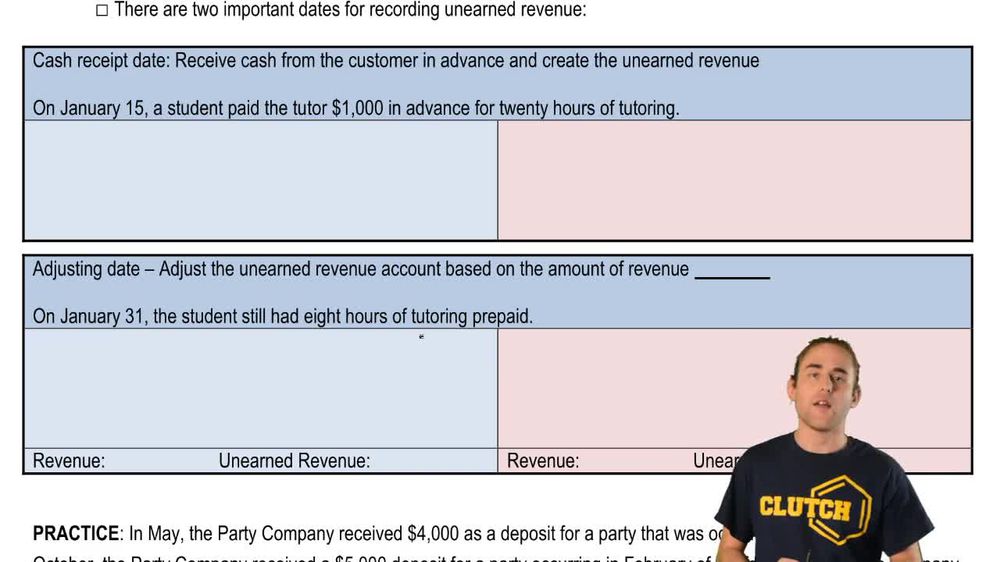

Adjusting Entries: Unearned Revenue

3. Accrual Accounting Concepts

Adjusting Entries: Unearned Revenue

Practice this topic

- Multiple Choice

In May, the Party Company received \$4,000 as a deposit for a party that was occurring in November. In October, the Party Company received a \$5,000 deposit for a party occurring in February of the following year. The company recorded both of these payments into the Unearned Revenue account and did not adjust the account after recording the payments. The adjusting entry at December 31 would include:

537views17rank - Multiple ChoiceWhich of the following pre-payments requires an adjusting entry at the end of the year to recognize revenue earned?58views

- Multiple ChoiceWhich of the following is the correct adjusting entry to recognize revenue earned from previously recorded unearned revenue?89views

- Multiple ChoiceWhich of the following does NOT apply to unearned revenues?104views