14. Financial Statement Analysis

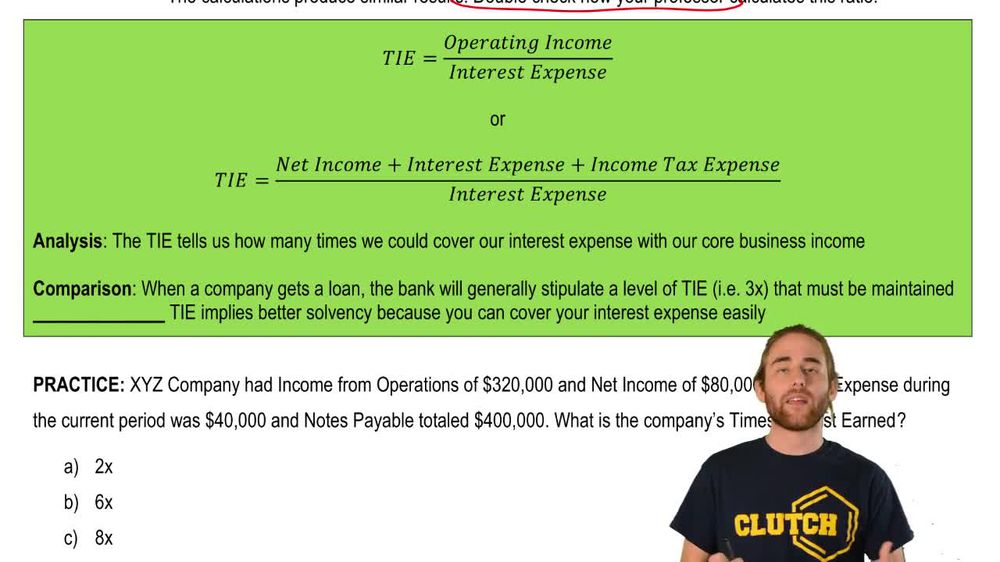

Ratios: Times Interest Earned (TIE)

14. Financial Statement Analysis

Ratios: Times Interest Earned (TIE)

Practice this topic

- Multiple Choice

XYZ Company had Income from Operations of \$320,000 and Net Income of \$80,000. Interest Expense during the current period was \$40,000 and Notes Payable totaled \$400,000. What is the company's Times Interest Earned?

185views2rank - Multiple Choice

ABC Company had Net Income during the period of \$60,000 after Income Taxes of \$40,000. Furthermore, the company had outstanding Notes Payable at the beginning and end of the year, respectively, of \$250,000 and \$350,000. If interest expense was \$15,000 during the period, what is the company's TIE ratio?

249views2rank - Multiple ChoiceWhat effect will issuing more bonds typically have on the Times Interest Earned (TIE) ratio over time, assuming operating income remains constant?89views

- Multiple ChoiceWhich of the following formulas is used to compute the Times Interest Earned (TIE) ratio?96views