8. Long Lived Assets

Depreciation: Straight Line

8. Long Lived Assets

Depreciation: Straight Line

Practice this topic

- Multiple Choice

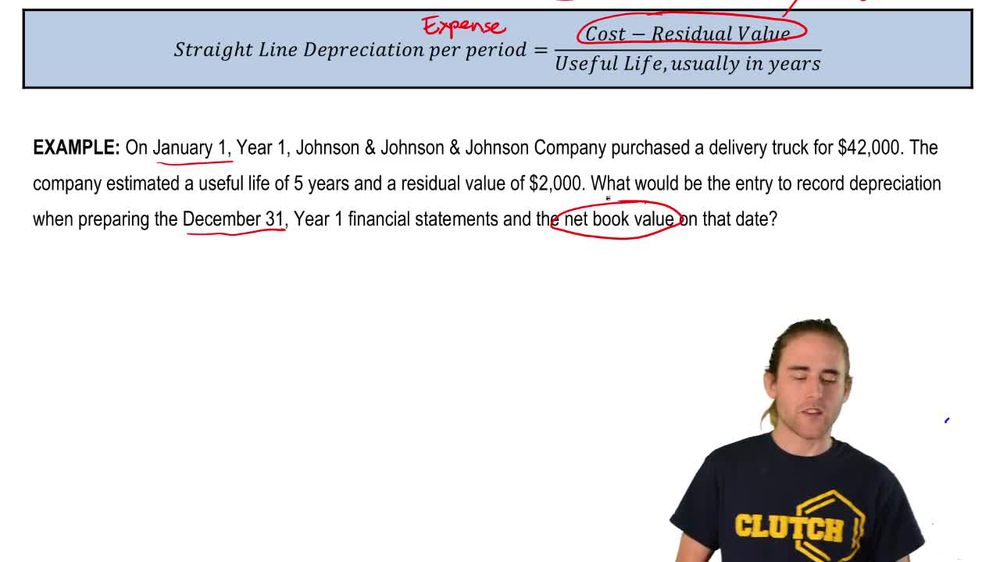

ABC Company purchased a new machine on January 1, Year 1 for \$44,000. The company expects the machine to last ten years. The company thinks it could sell the scrap metal from the machine for \$4,000 at the end of its useful life. If the company uses the straight-line method for depreciation, what will be the net book value of the machine on December 31, Year 4?

375views5rank - Multiple Choice

DBQ Company purchased a machine on January 1, Year 1 for \$60,000. The company estimated a five year useful life and \$8,000 residual value. If the company uses the straight-line method for depreciation, what will be the amount of accumulated depreciation on December 31, Year 2?

351views5rank - Multiple ChoiceUnder the straight-line method of depreciation, what is the average dollar amount of depreciation expense recorded after 1 year for an asset with a cost of \$10,000, a residual value of \$2,000, and a useful life of 4 years?36views

- Multiple ChoiceWhich of the following depreciation methods allocates the cost of long-term assets based solely on the passage of time?95views